-

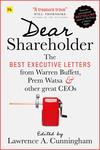

Dear Shareholder: The Best Executive Letters from Warren Buffett, Prem Watsa and Other Great CEOs

Lawrence A. Cunningham

The shareholder letters of corporate leaders are a rich source of business and investing wisdom. There is no more authoritative resource on subjects ranging from leadership and management to capital allocation and company culture.

But with thousands of shareholder letters written every year, how can investors and students of the corporate world sift this vast swathe to unearth the best insights?

Dear Shareholder is the solution!

In this masterly new collection, Lawrence A. Cunningham, business expert and acclaimed editor of The Essays of Warren Buffett, presents the finest writers in the genre of the shareholder letter, and the most significant excerpts from their total output. Skillfully curated, edited and arranged, these letters showcase the ultimate in business and investment knowledge from an all-star team.

Dear Shareholder holds letters by more than 20 different leaders from 16 companies. These leaders include Warren Buffett (Berkshire Hathaway), Tom Gayner (Markel), Kay Graham and Don Graham (The Washington Post and Graham Holdings), Roberto Goizueta (Coca-Cola), Ginni Rometty (IBM), and Prem Watsa (Fairfax).

Topics covered in these letters include the long-term focus, corporate culture and commitment to values, capital allocation, buybacks, dividends, acquisitions, management, business strategy, and executive compensation.

As we survey the corporate landscape in search of outstanding companies run by first-rate managers, shareholder letters are a valuable resource. The letters also contain a wealth of knowledge on the core topics of effective business management. Let Dear Shareholder be your guide.

-

Quality Shareholders: How the Best Managers Attract and Keep Them

Lawrence A. Cunningham

Anyone can buy stock in a public company, but not all shareholders are equally committed to a company’s long-term success. In an increasingly fragmented financial world, shareholders’ attitudes toward the companies in which they invest vary widely, from time horizon to conviction. Faced with indexers, short-term traders, and activists, it is more important than ever for businesses to ensure that their shareholders are dedicated to their missions. Today’s companies need “quality shareholders,” as Warren Buffett called those who “load up and stick around,” or buy large stakes and hold for long periods.

Lawrence A. Cunningham offers an expert guide to the benefits of attracting and keeping quality shareholders. He demonstrates that a high density of dedicated long-term shareholders results in numerous comparative and competitive advantages for companies and their managers, including a longer runway to execute business strategy and a loyal cohort against adversity. Cunningham explores dozens of corporate practices and policies—such as rational capital allocation, long-term performance metrics, and a shareholder orientation—that can help shape the shareholder base and bring in committed owners. Focusing on the benefits for corporations and their investors, he reveals what draws quality shareholders to certain companies and what it means to have them in an investor base. This book is vital reading for investors, executives, and directors seeking to understand and attract the kind of shareholders that their companies need.

-

Margin of Trust: The Berkshire Business Model

Lawrence A. Cunningham and Stephanie Cuba

Warren Buffett and his company, Berkshire Hathaway, are legendary for their distinctive investing approach. Yet many equally unconventional but less well known aspects of Berkshire’s managerial practices and organizational structure are rich with lessons for those seeking to follow in Buffett’s footsteps. Margin of Trust is the first book to distill Buffett’s approach to management and corporate life. It provides a definitive analysis of the tenets of the Berkshire system, its costs and benefits, and how it can be adapted for other organizations.

Lawrence A. Cunningham and Stephanie Cuba develop a new account of how Berkshire Hathaway works, showing that the key to its success is trust. Profiling partnership practices and business methods, they contend that Berkshire’s distinguishing feature is a culture in which autonomy and decentralization are core management principles. Cunningham and Cuba provide instructive examples of how this model has been successfully adapted by other companies that share a faith in trust as an organizing principle. They also offer candid commentary on the risks of a trust-based approach and how to mitigate them. Margin of Trust features illuminating analysis of Buffett’s take on the role trust plays in business agreements, what Buffett looks for in great corporate boards, and what lies ahead for Berkshire after its iconic leader leaves the scene.

-

The Cap: How Larry Fleisher and David Stern Built the Modern NBA

Joshua Mendelsohn

Today the salary cap is an NBA institution, something fans take for granted as part of the fabric of the league or an obstacle to their favorite team’s chances to win a championship. In the early 1980s, however, a salary cap was not only novel but nonexistent. The Cap tells the fascinating, behind-the-scenes story of the deal between the NBA and the National Basketball Players Association that created the salary cap in 1983, the first in all of sports, against the backdrop of a looming players’ strike on one side and threatened economic collapse on the other.

Joshua Mendelsohn illustrates how the salary cap was more than just professional basketball’s economic foundation—it was a grand bargain, a compromise meant to end the chaos that had gripped the sport since the early 1960s. The NBA had spent decades in a vulnerable position financially and legally, unique in professional sports. It entered the 1980s badly battered, something no one knew better than a few legendary NBA figures: Larry Fleisher, general counsel and negotiator for the National Basketball Players Association; Larry O’Brien, the commissioner; and David Stern, who led negotiations for the NBA and would be named the commissioner a few months after the salary cap deal was reached.

As a result, in 1983 the NBA and its players made a novel settlement. The players gave up infinite pay increases, but they gained a guaranteed piece of the league’s revenue and free agency to play where they wished—a combination that did not exist before in professional sports but as a result became standard for the NBA, NFL, and NHL as well.

The Cap explores in detail not only the high-stakes negotiations in the early 1980s but all the twists and turns through the decades that led the parties to reach a salary cap compromise. It is a compelling story that involves notable players, colorful owners, visionary league and union officials, and a sport trying to solidify a bright future despite a turbulent past and present. This is a story missing from the landscape of basketball history. -

The New Rules of Divorce: Twelve Secrets to Protecting Your Wealth, Health, and Happiness

Jacqueline Newman

The definitive guide to navigating divorce in today’s world from one of America’s top matrimonial lawyers.

Marriage as we know it in America has changed—and so, too, has divorce. Women are outearning men. Fathers are winning custody battles. Same-sex marriage is law. In this remarkably insightful and clear guide, elite New York City divorce attorney Jacqueline Newman shares her secrets from over two decades in the trenches. This book will help you:

-Decide whether you are actually ready to get a divorce

-Protect your finances and understand division of assets

-Find the right lawyer for your situation

-Win the child custody schedule you want

-Heal and stay sane in the midst of a disorienting time

Over the course of her career, Newman has implemented her strategies and coached her clients round the clock on how to navigate every aspect of their divorces. Now, in this landmark book, she offers the same tools and tactics to you. Newman also shines a light on the divorce industry where specialists of the trade financially benefit from drawn-out, high conflict cases. “Divorce,” she says, “can be simple, even if it is not amicable.”

Filled with hard-earned wisdom and a touch of humor, The New Rules of Divorce is an essential read for anyone looking to emerge from their breakup stronger, happier, and secure. -

Perspectives on Egypt, Islam, and the Dark Era of Trump

Yassin El-Ayouty

As a blogger, my focus has been in three directions: Egypt after Mubarak; the New Islamic Religious Revolution; and America’s attitudes towards both Egypt and the Islamic Revolution by which terrorism is being fought. This volume is a continuum of earlier volumes on the same topics. The only difference is the time span –from 2016 to 2018.

-

The Digital Dystopias of Black Mirror and Electric Dreams

Steven Keslowitz

This critical examination of two dystopian television series—Black Mirror and Electric Dreams—focuses on pop culture depictions of technology and its impact on human existence. Representations of a wide range of modern and futuristic technologies are explored, from early portrayals of artificial intelligence (Rossum's Universal Robots, 1921) to digital consciousness transference as envisioned in Black Mirror's "San Junipero."

These representations reflect societal anxieties about unfettered technological development and how a world infused with invasive artificial intelligence might redefine life and death, power and control. The impact of social media platforms is considered in the contexts of modern-day communication and political manipulation. -

The Warren Buffett Shareholder: Stories from inside the Berkshire Hathaway Annual Meeting

Lawrence A. Cunningham and Stephanie Cuba

In this engaging collection of stories, 43 veterans of the Berkshire Hathaway Annual Shareholders Meeting explain why throngs attend year after year. Beyond the famous Q&A with Warren Buffett and Charlie Munger, these experts reveal the Berkshire Meeting as a community gathering of fun, fellowship and learning.

The contributors whisk readers through the exciting schedule of surrounding events--book signings, panel discussions and social gatherings--and share the pulse of this distinctive corporate culture. Spanning decades, the book offers glimpses of the past and ideas of what lies ahead. To learn about what makes Buffett’s shareholders tick and all the happenings at the Berkshire Meeting, and to reminisce about past Meetings, make this delightful book your companion.

-

War on Jihadism By Ideology: The New Islamic Religious Revolution

Yassin El-Ayouty

The themes of this book have been in my head since Islamophobia in the West, especially with the rise of the ultra-right, degenerated into anti-Islamism. Jihadism which has been waging terrorism globally under the guise of Islam contributed greatly to lending that anti-Islamism a raison d’etre. With the two negative currents converging and becoming mutually self-justifying, Islam as a faith, and global security as a cherished value became the objects of skepticism. An enhancer of these trends has been the absence of translation of Arabic into other main languages. An example of this is the efforts by Al-Azhar Al-Sharif and its Grand Imam, Dr. Ahmed El-Taiyeb, exerted primarily from Cairo, are not well publicized in non-Arabic speaking areas. In that vacuum, both jihadism and anti-Islamism, crept in, nearly unchallenged.

-

Why You Better Call Saul: What Our Favorite TV Lawyer Says About Life, Love, and Scheming Your Way to Acquittal and a Large Cash Payout

Steven Keslowitz

"A wonderful new book...excellent...outstanding work!" ~ Vince Gilligan

Better Call Saul chronicles the transformation of a decent, likable guy named Jimmy McGill into Saul Goodman, the morally bankrupt lawyer we met on Breaking Bad. Captivating and funny, the show provides far more than a few binge-watched hours of entertainment, raising questions about the legal system and human nature itself. Why You Better Call Saul: What Our Favorite TV Lawyer Says About Life, Love, and Scheming Your Way to Acquittal and a Large Cash Payout examines the many faces of our favorite fictional lawyer, as well as other characters in the Breaking Bad/Better Call Saul universe:

- Is Saul Goodman a persona that Jimmy invents to attract a particular kind of client, or does he reflect Jimmy's true self?

- To what extent does Jimmy/Saul bend -- or break -- the rules to which attorneys are bound?

- What do Jimmy McGill and Mike Ehrmantraut have in common with Dexter Morgan?

- What do Jimmy's most important relationships teach us about the effect of outside influences on one's psyche?

- How do Saul Goodman and Walter White break free of societal constraints?

- How does Saul manipulate the media in order to promote his legal services? Is he defined by his tacky advertisements?

- And much more ...

-

The Buffett Essays Symposium: A 20th Anniversary Annotated Transcript

Lawrence A. Cunningham

Among the landmark occasions in the legendary history of Berkshire Hathaway and its iconic co-leaders, Warren Buffett and Charlie Munger, was a 1996 symposium held in New York at Cardozo Law School. The focus of the symposium was Warren's letters to Berkshire shareholders. The format was a series of panels with two dozen different experts dissecting all the ideas in the letters, about corporate governance, takeovers, investing, and accounting. Intellectual sparks illuminated the two-day affair, which drew unusual press interest for an academic convocation.

While the principal tangible result of the conference was the publication of the international best-seller, The Essays of Warren Buffett: Lessons for Corporate America, the transcript of the symposium is now being made available with annotations and updated commentary that show just how timeless the topics are and how venerable the principles Buffett laid out remain. Lawrence Cunningham had the honor of hosting the event, editing The Essays, and now publishing this archival treasure, with current assessments by such luminaries as Robert Hagstrom as well as several participants from the original symposium.

-

Quality Investing: Owning the Best Companies for the Long Term

Lawrence A. Cunningham, Torkell T. Eide, and Patrick Hargreaves

The concept of quality is familiar. People make judgments about it every day. Yet articulating a clear definition of quality is challenging. The best companies often appear to be characterized by an ineffable something, much like that of people who seem graced by a lucky gene. Think about those of your peers who seem a lot like you but somehow always catch a break. They are not obviously smarter, smoother, richer, or better-looking than you, yet they are admitted to their university of choice, get their dream job, and earn considerable wealth. Try to discern what they have that you don't, and you are stumped. Chalk it up to fate or plain dumb luck. Businesses can be similar. For reasons that are not always evident, some end up doing the right things with better results than average. They may not appear to be savvier acquirers, more adept marketers, or bolder pioneers, yet they integrate new businesses better, launch products more successfully, and open new markets with fewer mishaps. Perhaps through some combination of vision, scale, or business philosophy, these companies uncannily come out ahead. In our view, three characteristics indicate quality. These are strong, predictable cash generation; sustainably high returns on capital; and attractive growth opportunities.

-

Berkshire Beyond Buffett: The Enduring Value of Values

Lawrence A. Cunningham

Berkshire Hathaway, the $500 billion conglomerate that Warren Buffett built, is among the world's largest and most famous corporations. Yet, for all its power and celebrity, few people understand Berkshire, and many assume it cannot survive without Buffett. This book proves them wrong.

In a comprehensive portrait of the corporate culture that unites Berkshire's subsidiaries, Lawrence A. Cunningham unearths the traits that assure the conglomerate's continued prosperity. Riveting stories of each subsidiary's origins, triumphs, and journey to Berkshire reveal how managers generate economic value from intangibles like thrift, integrity, entrepreneurship, autonomy, and a sense of permanence.

Rich with lessons for those wishing to profit from the Berkshire model, this engaging book is a valuable read for entrepreneurs, business owners, managers, family business members, and investors, and it is an important resource for scholars of corporate stewardship. General readers will enjoy learning how an iconoclastic businessman transformed a struggling textile company into a corporate legacy.

-

Organ Donation and the Divine Lien in Talmudic Law

Madeline Kochen

This book offers a new theory of property and distributive justice derived from Talmudic law, illustrated by a case study involving the sale of organs for transplant. Although organ donation did not exist in late antiquity, this book posits a new way, drawn from the Talmud, to conceive of this modern means of giving to others. Our common understanding of organ transfers as either a gift or sale is trapped in a dichotomy that is conceptually and philosophically limiting. Drawing on Maussian gift theory, this book suggests a different legal and cultural meaning for this property transfer. It introduces the concept of the "divine lien," an obligation to others in need built into the definition of all property ownership. Rather than a gift or sale, organ transfer is shown to exemplify an owner's voluntary recognition and fulfillment of this latent property obligation.

-

The Global Governance of HIV/AIDS: Intellectual Property and Access to Essential Medicines

Obijiofor Aginam, John Harrington, and Peter K. Yu

The Global Governance of HIV/AIDS explores the implications of high international intellectual property standards for access to essential medicines in developing countries. With a focus on HIV/AIDS governance, the volume provides a timely analysis of the international legal and political landscape, the relationship between human rights and intellectual property, and emerging issues in global health policy. It concludes with concrete strategies on how to improve access to HIV/AIDS medicines.

-

The AIG Story

Lawrence A. Cunningham and Maurice R. Greenberg

In The AIG Story, the company's long-term CEO Hank Greenberg (1967 to 2005) and GW professor and corporate governance expert Lawrence Cunningham chronicle the origins of the company and its relentless pioneering of open markets everywhere in the world. They regale readers with riveting vignettes of how AIG grew from a modest group of insurance enterprises in 1970 to the largest insurance company in world history. They help us understand AIG's distinctive entrepreneurial culture and how its outstanding employees worldwide helped pave the road to globalization.

- Corrects numerous common misconceptions about AIG that arose due to its role at the center of the financial crisis of 2008.

- A unique account of AIG by one of the iconic business leaders of the twentieth century who developed close relationships with many of the most important world leaders of the period and helped to open markets everywhere

- Offers new critical perspective on battles with N. Y. Attorney General Eliot Spitzer and the 2008 U.S. government seizure of AIG amid the financial crisis

- Shares considerable information not previously made public The AIG Story captures an impressive saga in business history--one of innovation, vision and leadership at a company that was nearly--destroyed with a few strokes of governmental pens.

The AIG Story carries important lessons and implications for the U.S., especially its role in international affairs, its approach to business, its legal system and its handling of financial crises.

-

Contracts in the Real World: Stories of Popular Contracts and Why They Matter

Lawrence A. Cunningham

Contracts, the foundation of economic activity, are both vital and misunderstood. Contracts in the Real World, 2nd edition corrects common misunderstandings through a series of engaging stories involving such notable individuals as Martin Luther King, Maya Angelou, Lady Gaga, and Donald Trump. Capturing the essentials of this subject, the book explores recurring issues in contracting and shows how age-old precedents and wisdom still apply today and how contract law's inherent dynamism cautions against exuberant reforms. The accessible yet rigorous approach will appeal to the general reader and specialists alike, and to both teachers and students of contracts.

Originally published in 2012, there have been subsequent editions released since then.

-

Conducting Due Diligence in a Securities Offering

Stephanie J. Goldstein and Valerie Ford Jacob

Today's major financial scandals demonstrate what can happen when investigators fail to uncover illegal activity because they failed to do effective background searches. This title provides you with legal and procedural information that helps ensure you to do a thorough investigation of a company's records and its top managers.

Printing is not supported at the primary Gallery Thumbnail page. Please first navigate to a specific Image before printing.