Publication Date

2-1986

Journal

Texas Law Review

Abstract

This Article explores two prominent issues in current legal literature: the propriety of tax incentives in the federal income tax and the use of economic analysis to examine questions of concern to academic lawyers. One premise of this Article is that there is a connection between these two topics.

Volume

64

Issue

5

First Page

973

Last Page

1038

Publisher

The Texas Law Review Association

Keywords

Tax Incentives, Taxation, Taxation--Federal

Disciplines

Law | Taxation-Federal | Tax Law

Recommended Citation

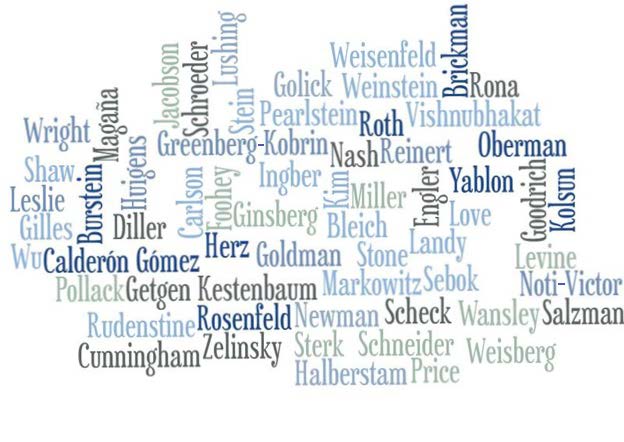

Edward A. Zelinsky,

Efficiency and Income Taxes: The Rehabilitation of Tax Incentives,

64

Tex. L. Rev.

973

(1986).

https://larc.cardozo.yu.edu/faculty-articles/655