Publication Date

1-23-2023

Journal

Tax Notes Federal

Abstract

In this article, Calderón Gómez examines a tax avoidance scheme involving private placement life insurance policies — large policies that potentially allow wealthy taxpayers to move their traditionally tax-inefficient investments in private equity and hedge funds into a life insurance policy and accumulate, borrow against, and pass on those investment gains effectively tax free — and sketches some possible alternatives to stop the abuse of these policies.

Volume

178

First Page

555

Publisher

Tax Analysts

Disciplines

Law | Tax Law

Recommended Citation

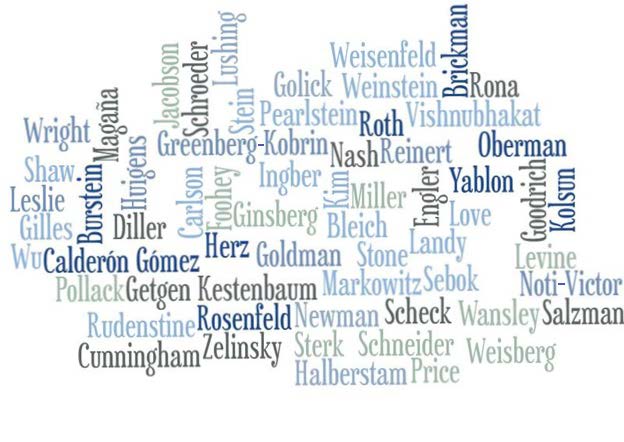

Luís C. Calderón Gómez,

Too Good to Be True: Private Placement Life Insurance Policies,

178

Tax Notes Federal

555

(2023).

https://larc.cardozo.yu.edu/faculty-articles/542