Publication Date

Spring 2022

Journal

Georgia Law Review

Abstract

One in ten adult Americans has turned to the consumer bankruptcy system for help. For almost forty years, the only systematic data collection about the people who file bankruptcy has come from the Consumer Bankruptcy Project (CBP), for which we serve as co-principal investigators. In this Article, we use CBP data from 2013 to 2019 to describe who is using the bankruptcy system, providing the first comprehensive overview of bankruptcy filers in thirty years. We use principal component analysis to leverage these data to identify distinct groups of people who file bankruptcy. This technique allows us to situate the distinctions among filers’ financial and household situations within what bankruptcy laws and courts can and cannot provide. We critique the consumer bankruptcy system, based on the totality of people who have used it recently, to identify avenues for reforming bankruptcy and to underscore the broader economic, racial, and social issues that consumer bankruptcy filings highlight.

Volume

56

First Page

573

Publisher

University of Georgia School of Law

Keywords

bankruptcy, consumer debtor, consumer debt, consumer credit, debt collection, mortgages, auto loans, student loans, financial fragility, racial disparity, gender disparity, divorce, garnishment, repossession, foreclosure, COVID-19, legal reform

Disciplines

Bankruptcy Law | Consumer Protection Law | Courts | Criminal Law | Criminal Procedure | Law | Law and Economics

Recommended Citation

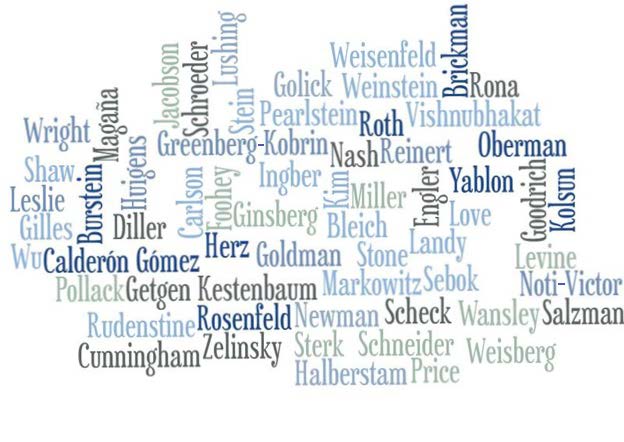

Pamela Foohey, Robert M. Lawless & Deborah Thorne,

Portraits of Bankruptcy Filers,

56

Ga. L. Rev.

573

(2022).

https://larc.cardozo.yu.edu/faculty-articles/691

Included in

Bankruptcy Law Commons, Consumer Protection Law Commons, Courts Commons, Criminal Law Commons, Criminal Procedure Commons, Law and Economics Commons